Our ML measures capture macro momentum effects on stocks through 3 channels

Markets’ Impact

Stock’s Fundamentals

Sectors’ Strength

Luccai’s volatility closely matches that of the stock index, given that it holds essentially the same largest stocks with dynamic ML weightings

Highlights

➤ Actively managed equity ETF allocations for Major Stock Market & US Stock Sector Indices designed to outperform net of fees.

➤ Allocations hold all stocks in the index at all times, with dynamic weightings changing monthly, or more quickly if needed.

➤ Annual turnover rates run less than 100%.

➤ For big indices such as World, World ex-US, and Emerging markets, the allocations hold the 100 largest capitalization stocks.

➤ Luccai’s long-term allocation model at certain points in the global cycle will include holdings in US treasuries and cash.

➤ The ETF allocations can be managed as funds or AMCs, with fees fixed in coordination with the initial issuers.

Luccai Active Stock Market ETF Allocation Returns

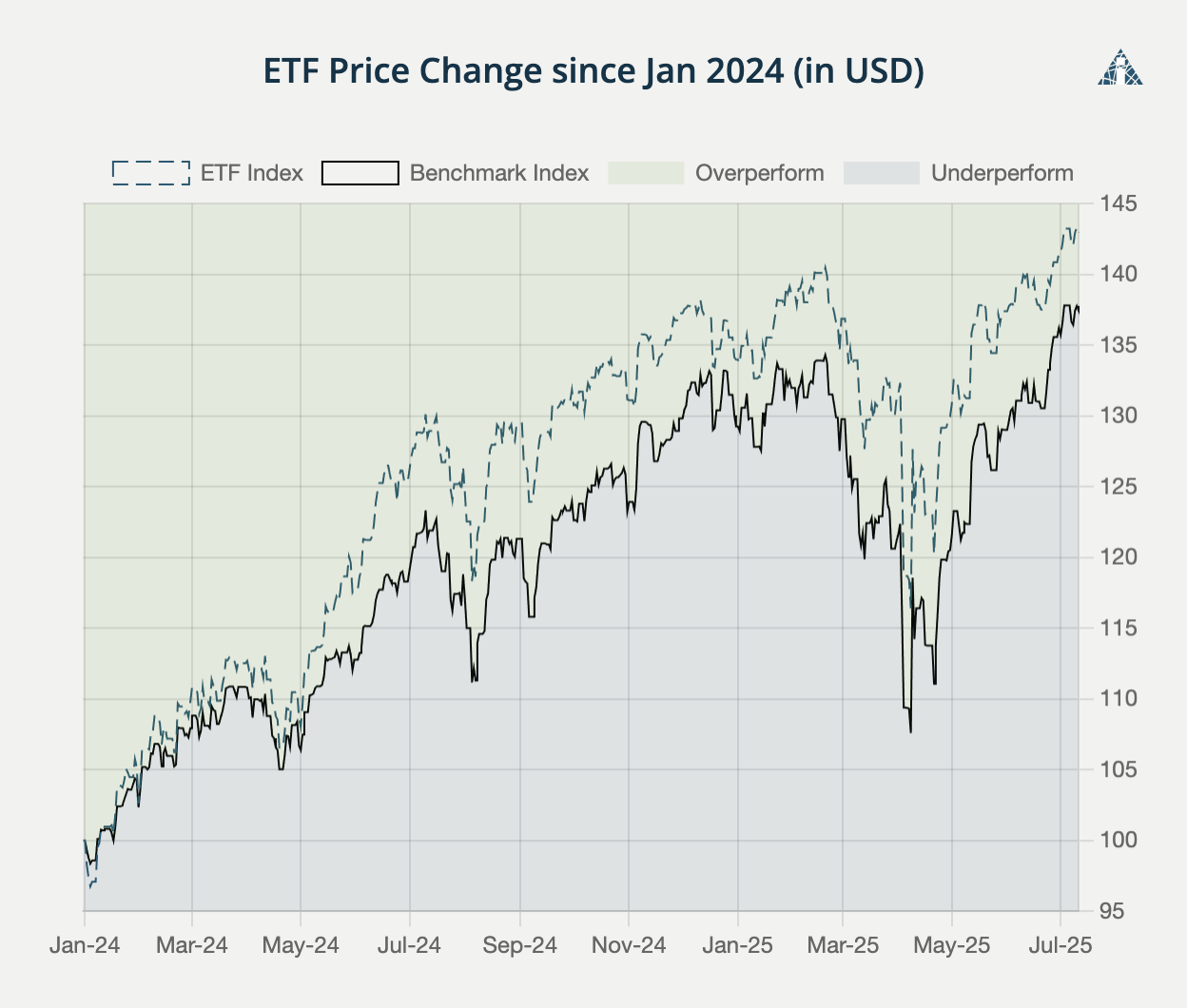

S&P500 Low Dynamic ETF

Chart showing the indicative price change from holding our dynamic ETF model allocations each month since Jan 2024. This is not a portfolio return, as it doesn't include transaction and management costs, and doesn't show dividends, but is indicative of the price changes of securities in the model over the period shown.

Past performance is not a guide to future performance. The value of your investment can fall as well as rise and you may not get back the original amount you invested.

Source: Luccai, Macrobond

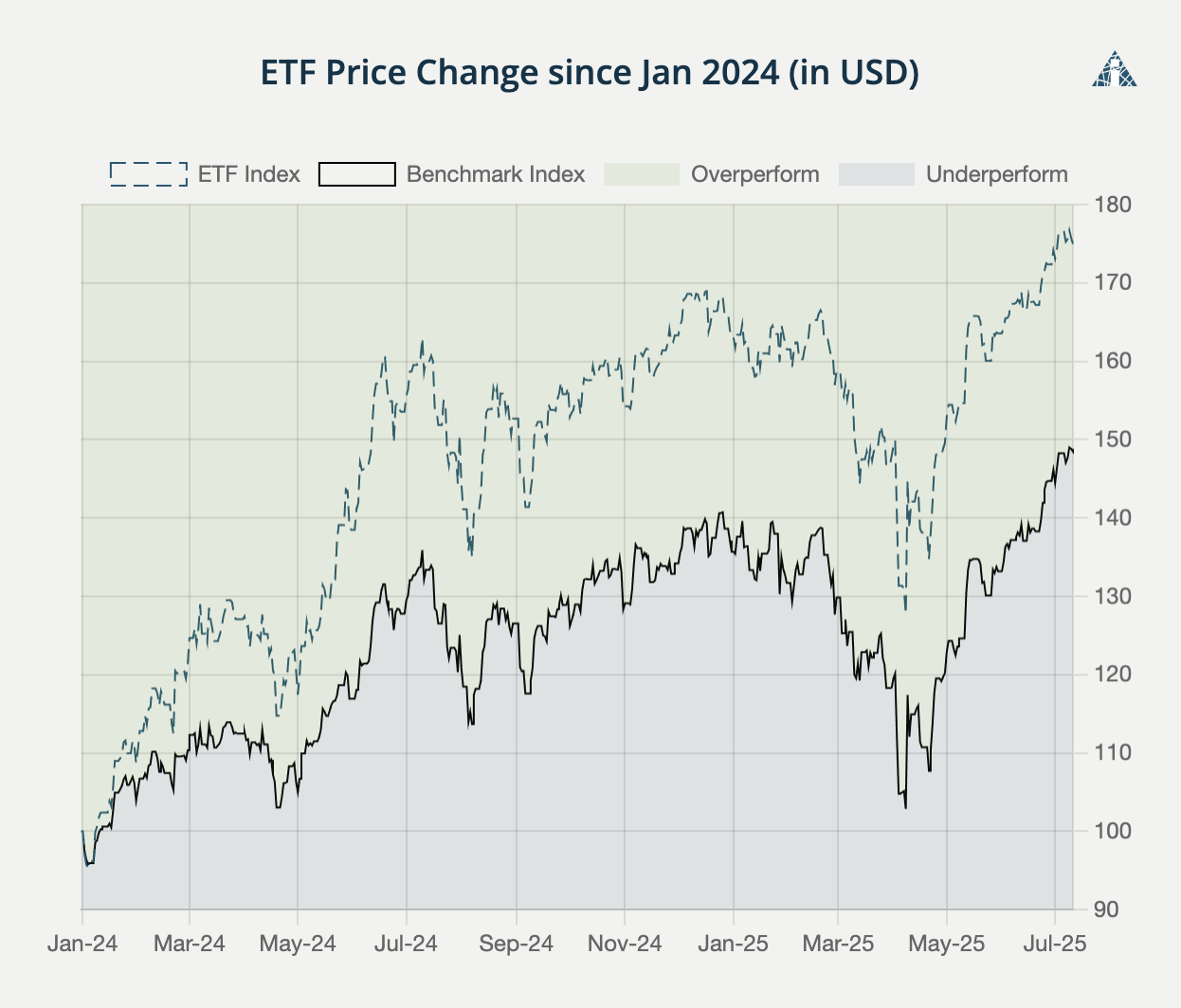

Luccai Active Stock Market ETF Allocation Returns

Chart showing the indicative price change from holding our dynamic ETF model allocations each month since Jan 2024. This is not a portfolio return, as it doesn't include transaction and management costs, and doesn't show dividends, but is indicative of the price changes of securities in the model over the period shown.

Past performance is not a guide to future performance. The value of your investment can fall as well as rise and you may not get back the original amount you invested.

Source: Luccai, Macrobond

Source: Luccai, Macrobond

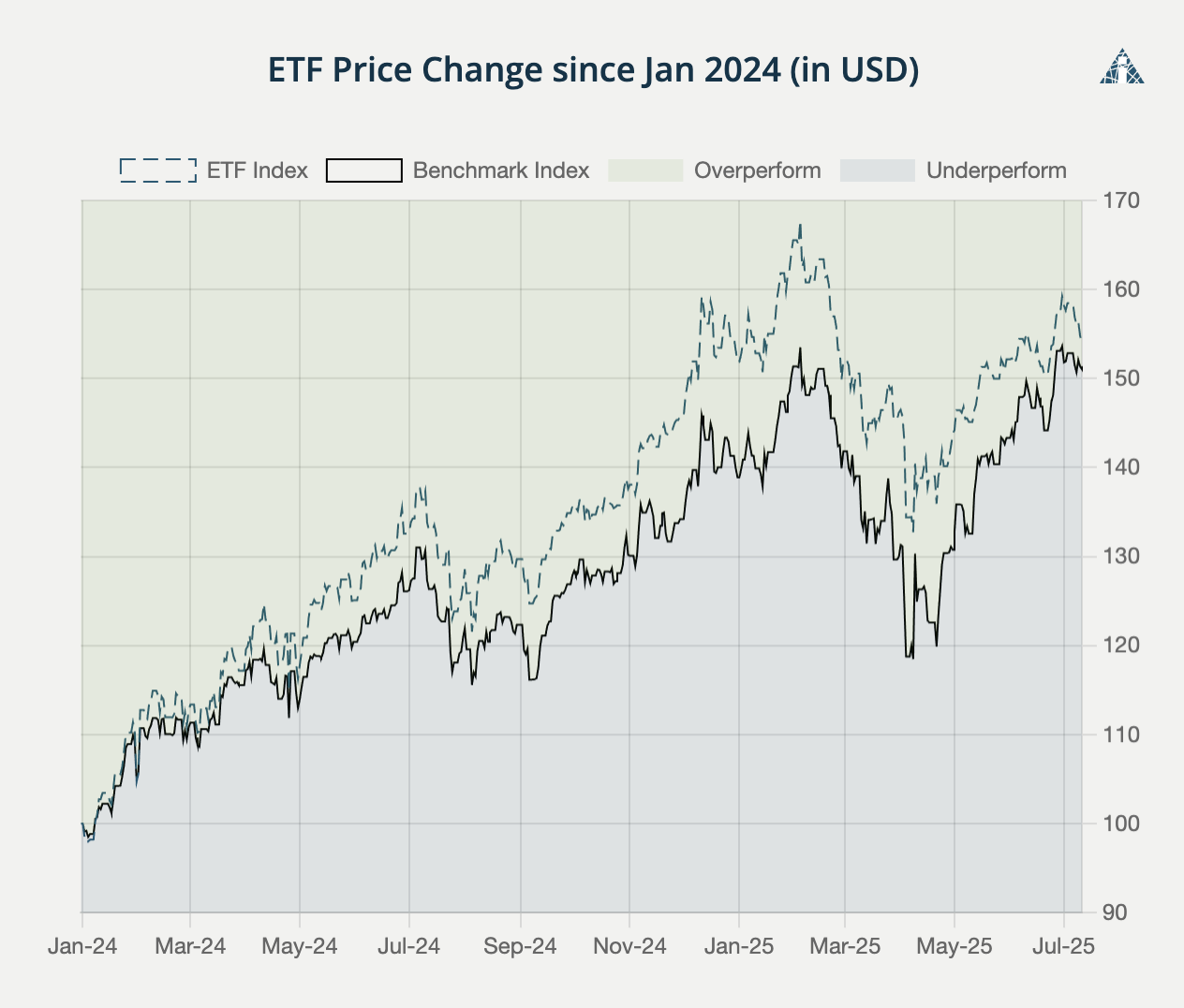

Luccai Active US Stock Sector ETF Allocation

Chart showing the indicative price change from holding our dynamic ETF model allocations each month since Jan 2024. This is not a portfolio return, as it doesn't include transaction and management costs, and doesn't show dividends, but is indicative of the price changes of securities in the model over the period shown.

Past performance is not a guide to future performance. The value of your investment can fall as well as rise and you may not get back the original amount you invested.

Source: Luccai, Macrobond

Luccai Active US Stock Sectors ETF Allocation

US Communications Low Dynamic ETF

|

%

|

Holding |

$ MTD % Change

|

|---|---|---|

| 22.6 |

Netflix

|

-5.76 |

| 15.0 |

Verizon Communications

|

-3.91 |

| 14.2 |

Alphabet

|

3.06 |

| 13.2 |

At&T

|

-6.15 |

| 8.5 |

Meta Platforms

|

-2.33 |

| 7.6 |

T Mobile Us

|

-4.24 |

| 6.4 |

Walt Disney

|

-3.26 |

| 5.1 |

Comcast

|

-0.14 |

| 3.0 |

Electronic Arts

|

-6.81 |

| 2.1 |

Take Two Interactive

|

-1.81 |

| 1.7 |

Charter Communications

|

-2.25 |

| 0.6 |

Omnicom Group

|

0.99 |

Chart showing the indicative price change from holding our dynamic ETF model allocations each month since Jan 2024. This is not a portfolio return, as it doesn't include transaction and management costs, and doesn't show dividends, but is indicative of the price changes of securities in the model over the period shown.

Past performance is not a guide to future performance. The value of your investment can fall as well as rise and you may not get back the original amount you invested.

Source: Luccai, Macrobond

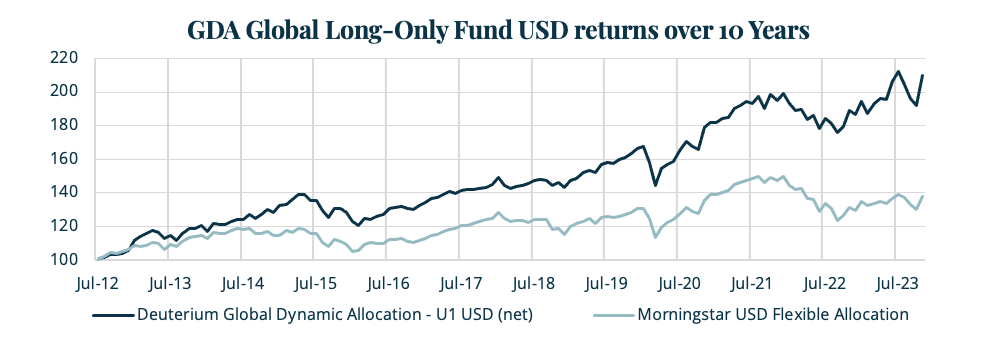

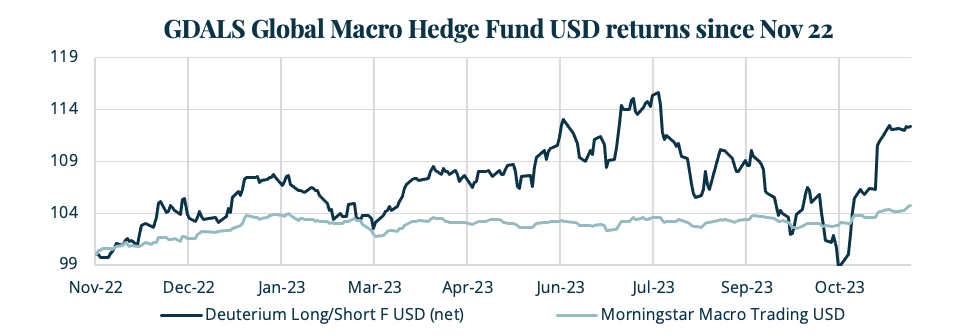

Lead Manager Returns through January 2024

GDA USD Morningstar

GDA GBP Trustnet

Top 96%

of mixed-allocation peers over past year on Bloomberg (more than 5000 funds)

Morningstar

five-star rating in recognition of stellar returns - GDA USD

Trustnet

five-crown rating in the top 10% of UK funds - GDA GBP

Top 96%

of macro hedge fund peers YTD on Bloomberg (about 200 funds)

Source: Bloomberg

Past performance is not a guide to future performance. Refer to important disclaimers at the end of this presentation.

Source: Deuterium, Morningstar, Trustnet

Lead Manager Pioneer of quantitative global macro portfolio strategies

Global Macro manager for Deuterium Capital Management, Jupiter Asset Management, Merian Global Investors, Head of global asset allocation for Alliance Bernstein, Manager of 10 billion Cursitor Global Asset Rotation Fund, Manager of the Wealth Fund for Iveagh Ltd, Co-founder of Cursitor and Kestrel Investment Partners, and founder of Bullrun Financial.

Features

US Stock Macro Momentum analytics and scores

Online access to US stock scores for circa 500 US large capitalization stocks

Weekly published reports that summarize projected share price impacts

Global Economic Trend and Macro Momentum analytics and scores

Online access to broad market scores from Luccai’s quantitative systems

Weekly published reports that summarize projected market impacts

International Stock Macro Momentum analytics and scores

Online access to international stock scores for circa 225 Japanese, 100 UK, 50 Continental European, 50 Chinese, and 50 Developing Market large capitalization stocks

Weekly published reports that summarize projected share price impacts

Qualitative Global Macro Projections

Video calls with Luccai partners

Global asset allocation and sector/security selection projections reflecting Luccai’s quantitative systems and qualitative assessments

Important Disclosures

This communication is issued by Lucca LLC, 100 S.West Street, Suite 100 Wilmington, Delaware, 19801 USA. It is intended solely for general guidance and information purposes. It is not to be used or considered as financial or investment advice, a recommendation, an offer to sell, or a solicitation to buy any securities or other financial assets. This document is not an offer document. It should not be regarded as investment research or an objective or independent analysis of the matters contained herein, and it is not prepared in accordance with regulations governing investment analysis. The information in this report is obtained from various sources as of the report’s date. We have taken reasonable care to ensure that, and to the best of our knowledge, material information contained herein is accurate and free of omissions that could affect its understanding. All valuation estimates or other estimates presented are prepared by Lucca LLC from information obtained from third parties as part of the analytic service for the financial markets included in the report. These estimates are subject to risks, uncertainties, and other factors that may cause actual events to differ materially from any anticipated developments. We do not guarantee that the underlying forward-looking statements are error-free. Readers should not place undue reliance on forward-looking information, which depends on numerous factors, and must independently assess such projections. Lucca LLC does not make any representation or warranty, express or implied, regarding the accuracy or completeness of this report, and Lucca LLC will not have any liability to any other person resulting from your use of this report. There may have been changes affecting the companies since the date of this report. The issuance or delivery of this report does not imply that the information contained herein is accurate as of any date subsequent to the report’s date or that the market prospects have remained unchanged. Lucca LLC does not intend to, and does not assume any obligation to, update or correct the information in this report. This report does not consider any specific investment objectives, financial situations, or the particular needs of any individual. The contents of this report should not be construed as legal, business, investment, or tax advice. Each recipient should consult their legal, business, investment, and tax advisors for such advice. Investors should understand that statements regarding future prospects may not be realized, and that past performance is not necessarily indicative of future results. All investments mentioned in this report carry the risk of loss. The information contained herein may be subject to changes without prior notice. Lucca LLC accepts no liability, whether legal or financial, for any loss (direct or indirect) resulting from the understanding and/or use of this report or its content. This report is intended solely for the recipients and should not be copied or otherwise distributed, in whole or in part, to any other person.

This document is provided for information purposes only, it does not replace official documents. Refer directly to official fund documentation as no representation or warranty is made as to the accuracy or completeness of information in this publication. This publication is for your information only and is not intended as an offer, or a solicitation of an offer, to buy or sell any investment or other specific product. Certain services and products are subject to legal restrictions and cannot be offered worldwide on an unrestricted basis and/or may not be eligible for sale to all investors. All information and opinions expressed in this document were obtained from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to its accuracy or completeness. All information and opinions as well as any prices indicated are currently as of the date of this report and are subject to change without notice. The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. Some investments may not be readily realizable since the market in the securities is illiquid and therefore valuing the investment and identifying the risk to which you are exposed may be difficult to quantify. Futures and options trading is considered risky. Past performance of an investment is no guarantee for its future performance. Some investments may be subject to sudden and large falls in value and on realization you may receive back less than you invested or may be required to pay more. Changes in foreign exchange rates may have an adverse effect on the price, value or income of an investment. CHF Capital SA expressly prohibits the distribution and transfer of this document to third parties for any reason. CHF Capital SA will not be liable for any claims or lawsuits from any third parties arising from the use or distribution of this document. This report is for distribution only under such circumstances as may be permitted by applicable law. The “Directives on the Independence of Financial Research”, issued by the Board of Directors of the Swiss Bankers Association (SBA) do not apply. These materials are confidential and intended solely for the information of the person to whom it has been delivered. Recipients may not reproduce or transmit this information, in whole or in part, to third parties. This document may not be distributed in countries where such distribution would constitute a violation of applicable laws or regulations. This document does not constitute an offer of securities. Such an offer will only be made by means of a confidential offering memorandum.